The global dairy market continues its downward trend. According to the IFCN World Milk Price Index, international milk prices fell again in October 2025 — down 2.2% compared with September. This marks the fifth consecutive month of decline, pushing prices back to levels last seen in December 2024.

The question now facing producers and processors worldwide is simple: how long can they withstand this pressure before the market finds balance again?

Why Are Milk Prices Falling?

The core problem is imbalance. Global milk supply keeps expanding, while demand remains largely stagnant. This supply–demand gap has been widening since early 2025, putting sustained pressure on farm-gate milk prices and the broader dairy value chain.

Butter and Powder Drive the Downturn

Butter and whole milk powder (WMP) have led the recent market decline. Butterfat output has been strong across almost all key dairy regions — a sharp contrast to the shortages seen at the beginning of the year. Even the United States, which started 2025 as a net importer, has now become a net exporter, reshaping global trade dynamics.

In Oceania, seasonal output has surged, flooding the market with milk powder and pushing prices lower. Cheese, on the other hand, has remained more resilient so far, thanks to relatively stable retail and foodservice demand.

Global Milk Production on the Rise

Production growth has been particularly robust in the third quarter of 2025:

New Zealand: Output continues to grow year-over-year, supported by favorable pasture conditions.

United States: Expanding herds and higher yields are raising total milk volumes.

Europe: Competitive margins, lower input costs, and improved farm conditions keep producers productive.

Latin America: Improved weather and stable feed costs have boosted production.

This synchronized growth across key producing regions has created a strong supply wave. Combined with steady—but not accelerating—demand, it is pushing global milk prices lower month after month.

How Long Can the Market Hold?

On-farm indicators already show spot milk prices adjusting downward, suggesting that farm-gate prices may face more pressure in late 2025 and early 2026. For many farmers, tighter margins mean delayed investment, reduced herd growth, and cost-cutting measures.

Until production slows in response to weaker profitability, the global imbalance is likely to persist. The next few months could bring a turning point — if falling prices begin forcing output reductions, the market may finally stabilize.

Outlook: Signs to Watch in 2026

Analysts expect that any meaningful recovery will depend on three major factors:

- Global demand rebound — especially from import-heavy markets like China and North Africa.

- Production response — farmers scaling back in high-cost regions.

- Feed and energy prices — which determine how long producers can sustain current output levels.

The dairy sector has proven resilient before, but sustained low prices could test even the most efficient producers. The coming quarters will reveal whether the global milk market can self-correct — or if deeper structural change is on the horizon.

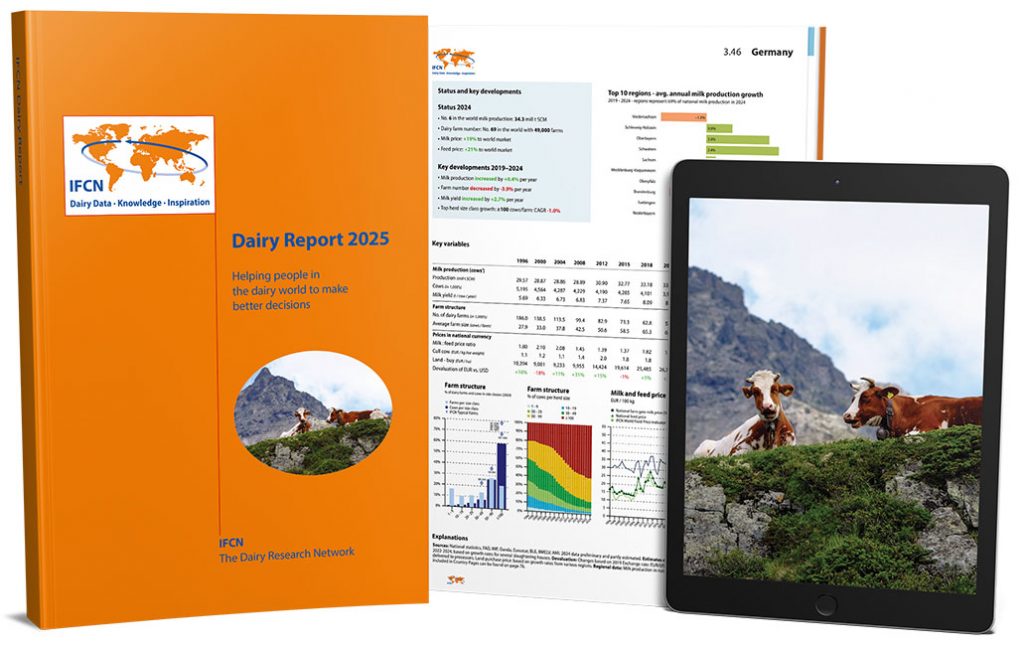

NEW IFCN Dairy Report 2025

Get your personal copy NOW!

A comprehensive overview of the complex dairy world in a 224-page book based on IFCN research.